Investment Pyramid: Crafting Stability in a Volatile Market

Updated August 27, 2024

An investment or risk pyramid is a strategic framework for portfolio allocation based on the risk levels associated with different investments. In this approach, the degree of risk in an investment is characterized by the variance in its potential return or the probability that the investment might significantly decrease in value.

At the foundation of the investment pyramid, we find low-risk investments occupying the broadest segment. These low-risk assets are typically characterized by their stability and minimal fluctuations in value over time. Investors opt for these assets when seeking a secure foundation for their portfolio, aiming to safeguard their capital while generating modest returns.

Moving up the pyramid, the mid-portion is dedicated to growth investments. These investments carry a higher degree of risk compared to low-risk assets but also offer the potential for greater returns. Growth investments often include stocks of established companies exhibiting promising growth prospects or mutual funds focusing on capital appreciation over the long term. While these assets might experience more significant fluctuations, they are favoured by investors with a moderate risk appetite who seek to balance potential gains with a manageable level of risk.

The pyramid’s apex houses speculative investments, representing the smallest allocation in the portfolio. Speculative investments come with substantial risk due to their inherent uncertainty and potential for significant price swings. These could include high-risk startup stocks, volatile commodities, or other assets prone to rapid value changes. Investors who allocate a portion of their portfolio to speculative investments are typically willing to tolerate higher levels of risk in pursuit of potentially substantial rewards.

Examples of investments for each layer of the pyramid

– Low-risk investments: high-quality bonds, treasury securities, and money market funds

– Growth investments: blue-chip stocks, dividend-paying stocks, and index funds

– Speculative investments: penny stocks, cryptocurrencies, and leveraged ETFs

Unlocking Success with the Investment Pyramid: Mastery Rooted in Mass Psychology

The investment pyramid is more than just a blueprint for diversification—it’s a strategic framework that taps into the psychological underpinnings of successful investing. While it advocates for spreading investments across a range of asset classes to manage risk, the true mastery lies in understanding how mass psychology influences market movements and leveraging this insight to make informed decisions.

At the heart of this strategy is the allocation of investments across three layers—base (low risk), middle (moderate risk), and apex (high risk). By doing so, investors can tailor their portfolios to align with their financial goals and risk tolerance while enhancing the potential for superior returns. However, unlocking the pyramid’s potential extends beyond its structural foundation; it involves developing a nuanced approach to identifying high-potential stocks within robust sectors, guided by an awareness of collective market sentiment.

Investment legends Warren Buffett and Charlie Munger emphasize the importance of understanding human behaviour in financial markets. They argue that much of the market’s volatility is driven by emotions such as fear and greed, which often lead to irrational decision-making. By staying disciplined and focusing on the fundamentals, investors can avoid the pitfalls of herd mentality and capitalize on opportunities that others may overlook.

A key aspect of this approach is discerning stocks that are either poised for a breakout or already demonstrating strong upward momentum. Buffett and Munger have long advocated for a focus on companies with durable competitive advantages and strong management, which are more likely to thrive even in the face of market fluctuations.

In this light, the investment pyramid becomes a tool for diversification and strategic decision-making, rooted in an understanding of mass psychology. By integrating these psychological insights with a rigorous analysis of stock potential, investors can achieve returns that are above average and sustainable over the long term. This approach, when combined with the wisdom of seasoned investors like Buffett and Munger, positions the investment pyramid as a pathway to enduring financial success.

Identifying Emerging Stars and Stocks on the Cusp of a Breakout

Investors should focus on sectors with solid fundamentals and positive growth trajectories to pinpoint potential breakout stocks effectively. Technical analysis tools such as moving averages, the Relative Strength Index (RSI), and volume indicators can provide critical insights into stocks exhibiting bullish trends.

For instance, consider a technology company that has consistently introduced innovative products and is capturing an increasing market share. Such a company could be a prime candidate for substantial growth. A real-world example is Nvidia in the early 2010s, which capitalized on the burgeoning demand for graphics processing units (GPUs) in gaming and, later, in AI technology. Nvidia’s stock exhibited strong technical indicators and sector fundamentals that aligned well with the growth in tech-driven markets.

Similarly, in the healthcare sector, a company like Pfizer demonstrated significant potential leading up to and during the rollout of its COVID-19 vaccine. The company’s stock responded positively to its vaccine’s successful development and approval, illustrating how regulatory milestones can catalyse stock growth.

By integrating these strategies—focusing on solid sectors, employing technical analysis and mass psychology—investors can better navigate the market’s complexities. This turns the investment pyramid’s theoretical structure into a practical tool for achieving long-term investment success.

Mastering Investment Strategies: Swing Trades and Options for Growth and Stability

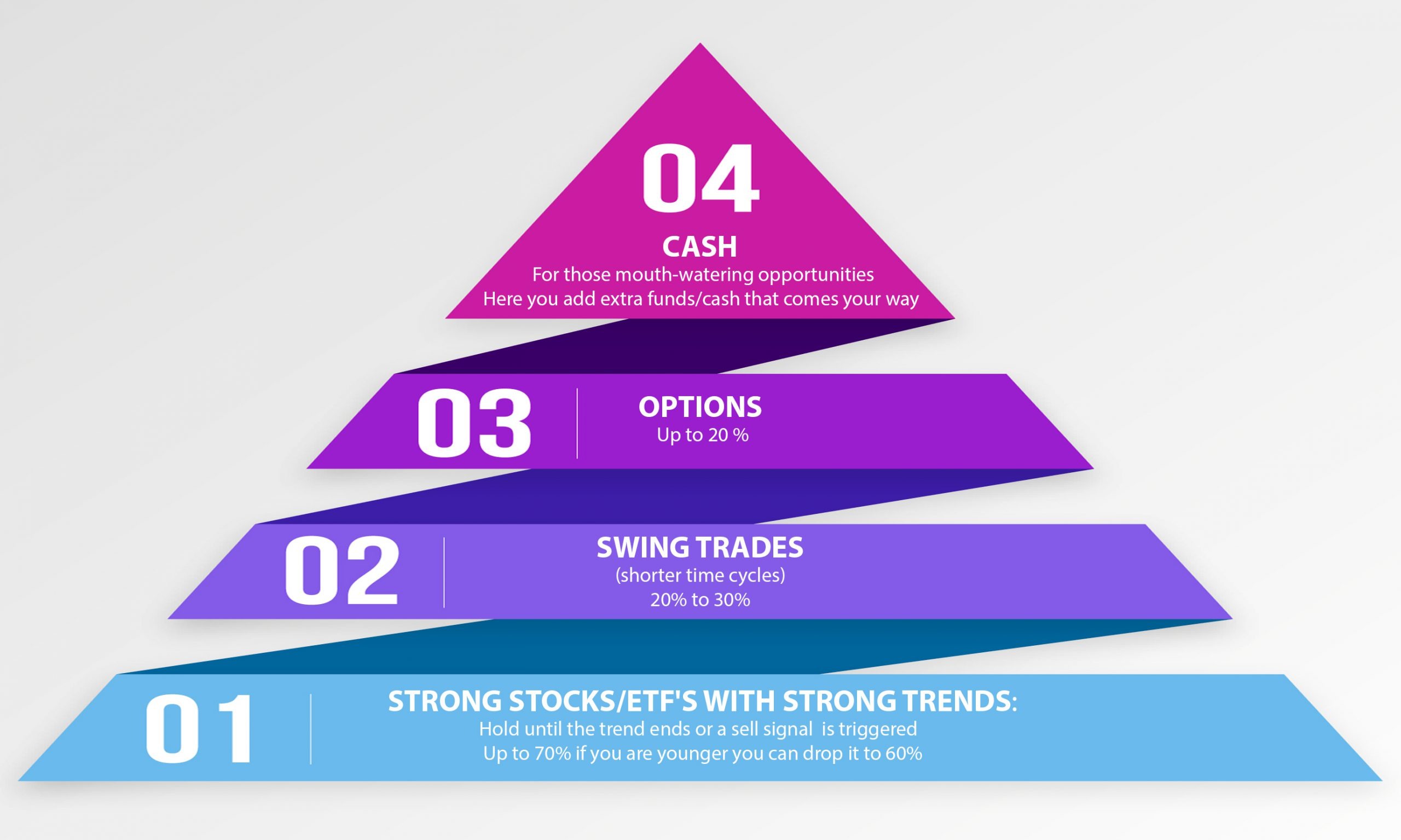

Allocating between 20% to 30% of your investment funds towards swing trades can significantly enhance your portfolio’s performance compared to day trading. Unlike the high-risk and often disappointing outcomes of day trading, swing trading involves holding positions for three to six months. This strategy mitigates excessive risk and capitalizes on medium-term market trends, optimizing potential returns.

As we delve deeper into the investment pyramid, options trading emerges as a compelling component, offering the potential for substantial returns or a consistent income stream. To maintain a balanced risk profile, it is crucial to limit options trading to no more than 20% of your portfolio. By distributing this allocation across six to ten different positions, investors can manage risk effectively while maximizing the profit potential.

Effective Options Investing Within the Investment Pyramid

– Emphasize high-probability strategies such as covered calls, cash-secured puts, and spreads to enhance potential returns while controlling risk.

– Keep options exposure limited to a manageable portfolio segment, diversifying across multiple positions to mitigate potential losses.

– Regular monitoring and adjustment of options positions are essential, considering changing market conditions and the performance of the underlying stocks.

Strategic Diversification: Optimizing Your Investment Approach

Strategic diversification is more than just spreading your investments across various asset classes. For example, if you have $100,000 to invest, dividing it into ten equal parts of $10,000 each and subdividing each part into three smaller lots allows for staggered investments in the same stocks or options. This technique capitalizes on price dips and enhances potential gains while mitigating risk.

Our investment pyramid guides investors from foundational investments like stocks and ETFs to more nuanced strategies like swing trades and options. For instance, you create a balanced portfolio by investing in a solid ETF at the base level and using swing trades for a mid-level stock showing strong momentum. This systematic progression fortifies your position against market volatility, ensuring that each level contributes to overall portfolio growth. By adhering to this structured approach, investors can achieve a harmonious balance between stability and development, making their portfolios resilient against the complexities of financial markets.

Revealing Nuances in Market Dynamics: Beyond Investment Structures

Pay attention to market sentiment indicators like the CBOE Volatility Index (VIX) and investor surveys to gauge overall market mood

– Monitor Federal Reserve actions and statements, as they can significantly impact market sentiment and direction

– Adapt the investment pyramid strategy based on prevailing market conditions, potentially shifting allocations between risk levels as sentiment and Fed actions dictate

The system is going to be flooded with so much liquidity that the markets will melt upwards when the media starts to report the data more accurately. Right now, they talk about the mortality rate without breaking the data down and informing the masses that older individuals are the ones that fall into the high-risk category. Even then, most of them appear to have some other complications already. Market Update March 18, 2020

A Frenzy Amidst Uncertainty

Undoubtedly, the current juncture presents one of the most formidable challenges since the onset of the 2008 financial crisis. Hysteria has taken hold, particularly within the U.S., fueling a self-perpetuating frenzy from the highest echelons to the grassroots, leaving everyone in a whirlwind of activity akin to headless chickens.

Everyone at the Tactical Investor is freeing up all the available cash they can. We have spoken of living below one’s means in the past, and we all intend to drop down and live 1 to 2 standards below our means temporarily and direct these savings towards the market. Please don’t take this as a sign to throw caution to the wind; we will deploy capital in a disciplined and controlled as we have always advocated. Market Update March 24, 2020

Unlocking Potential: The Power of Bearish Sentiment

Remarkably, bearish sentiment serves as an unexpected catalyst for robust market rallies. We are on the brink of what can be aptly dubbed the “mother of all buy signals.” A minor downward shift is required to align our indicators, poised to activate this pivotal signal and usher in a new wave of opportunity.

We are dangerously close to hitting the upper limit of the madness zone. Remember that before this pandemic, the gauge never even hit the extreme end of the hysteria zone. So, this is an unprecedented development. Given this massive move in the anxiety gauge, neutral readings would now need only to dip down to 10% to trigger the “father of all buy signals” provided our technical indicators move to the extremely oversold ranges and the Trend indicator remains positive (bullish). Market Update March 30, 2020

Crash Course: Thriving Amid Shifting Market Sentiment

Remember, for most of 2023 and the last few months of 2022, bullish sentiment traded below its historical average of 39. It remained in this range for almost 18 months while the markets drifted higher. This is unprecedented. Jesse Livermore wisely noted, “The big money is not in the buying and selling but in the waiting.” This aligns perfectly with embracing strong pullbacks and market crashes until sentiment changes.

John Templeton’s contrarian approach also supports this notion, as he famously stated, “To buy when others are despondently selling and to sell when others are avidly buying requires the greatest fortitude and pays the greatest ultimate rewards.” Investors can position themselves for significant gains by capitalising on market sentiment shifts.

Moreover, Charlie Munger’s emphasis on patience and discipline in investing is crucial during these times. “The big money is not in the buying or the selling, but in the waiting,” he once said. This reinforces the importance of remaining patient and disciplined, even during market crashes, until sentiment shifts in our favour.

Hence, before this market crashes, bullish sentiment will have to trade at elevated levels, at least above 55, if not 60, for several weeks before we can state that a long-term top is in place and the markets are ready to crash. Until that occurs, all pullbacks ranging from medium to strong should be embraced. Thriving amid shifting market sentiment requires fortitude, patience, and a willingness to go against the crowd, as demonstrated by the wisdom of Livermore, Templeton, and Munger—end of story.

Unearth Extraordinary Articles for Your Curiosity